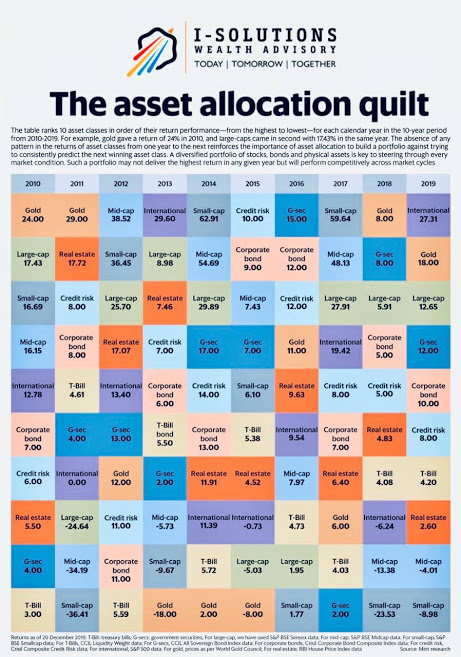

Nobody drives a car looking at the Rear View Mirror for driving ahead. Similarly, “past performance is not an indicator of future returns". Our picture depicts the same story that there is no fix formula for anything and no fix Asset Class which functions all the time. The randomness of short-term returns that gives the “quilt" effect shows the absence of any pattern that will help win the short-term game of selecting the asset that will be the winner in the next year. With the exception of gold, which was the top performer in 2010 and 2011 on fears of inflation, there was a different asset on top in each of the next eight calendar years. Each year, there was also a new combination of top-quartile performers, with no asset making the cut more than two years in a row, except for large-cap stocks.

All the vehicles on the road cannot ignore the bumpy ride depending on the types of roads and instruments like signals, flyovers, speed-breakers, diversions, etc. Similarly, each investment vehicle also faces bumpy ride which we call volatility in asset classes. For eg. Gold slid to the bottom of the table in the three years following its run at the top and remained a laggard till it again zoomed to the top quartile in the last two years. Another such example if real estate as asset class, the real returns to the investors, after deducting actual and opportunity costs, is much lower than what is indicated by the price movements.

To make things simple, let us highlight few takeaways from the performance table.

Have a well Defined Asset Allocation:

Asset allocation shows where you sit on the risk spectrum in relation to your investment horizon. This helps you take the emotions out of investment decisions and stay with the plan. Globally, it is believed that the maximum returns generated in a portfolio is not because of choosing a best performing fund or product. It is derived by having a well-defined asset allocation strategy as per the risk appetitie of ones needs and objectives. Also note, starting with a well-defined asset allocation is good but not changing frequently is also a crime. As a nomenclature, we say One should periodically Rebalance their portfolio. For example, the large-cap segment is seen as over-valued at their current levels but it’s still touching new highs. Rebalancing the portfolio if the allocation to large-caps has gone up significantly will allow you to book profits as well as benefit you from an upturn in other segments of your portfolio whose allocation has dipped.

Diversification is key:

As the famous phrase says “Never put all your eggs in one basket”. It is imperative that a well-diversified portfolio will never promise you of the highest returns but it acts as the protection against the asset class which may not be working in favor of the portfolio. And at the same time, the same asset class may also be the top performer in the following year, shoring up the portfolio’s returns. Over time, you will see the benefit of diversification and how it smoothens out the ride, especially when you have greater exposure to asset classes like mid- and small-cap stocks that tend to see feast or famine situations and can do with some companions to tame short-term volatility in returns.

Focus on long term:

There are no advantages to looking at short-term returns of individual asset classes because they have no predictive properties. Instead, focus on your goals and needs—long-term or short-term—and build a portfolio aligned to them.

Remember, you do not allow anyone and everyone at your house for various reasons. Similarly, you should also not include each asset class in your portfolio. Asset Allocation should be based on your goals and if not done properly, they work negatively for your goals.